Why do startups need convertible loans?

A seed financing through convertible loans, is an ideal financing instrument in the early stages of any startup. This form of seed financing does not waste time on lengthy company valuations but instead grants a loan initially, which is then converted into company shares as part of a later financing round. Hence this financing instrument is very efficient and can quickly meet the urgent capital needs and valuation uncertainty of rapidly growing companies.

What is a convertible loan?

From a financial point of view, a convertible loan is a loan with the option of converting the sum into shares in the company at a later date. This conversion option is exercised at the time of the next financing round and at the valuation of the next financing round (more on the topics of discount, cap and floor later).

This approach is particularly suitable as seed financing or as bridge financing before a larger financing round or before the realization of a larger project. Since the conversion price is only determined in the subsequent financing round, the convertible loan provider and the founders initially avoid the valuation issue. Why? Especially in early company phases or when high growth rates are expected (but uncertain), the valuation of the start-up can be associated with great uncertainty and lead to lengthy discussions. The typical term of a convertible loan agreement of one year is usually sufficient to subject the forecast viability of the business model to a reality check and thus to carry out a company valuation at a time when better knowledge is available.

A convertible loan can be granted by someone outside the company, e.g. a business angel, or by one of the shareholders. A convertible loan agreement essentially contains the following provisions:

- Convertible loan sum

- Modalities of disbursement of the loan amount, e.g. one-off payment or in tranches, possibly depending on the fulfillment of certain criteria

- Duration of the contract

- Conversion event, i.e. time and modalities of conversion

- Other special regulations, e.g. discount, cap, floor, etc.

In general, it can be stated that both parties of the convertible loan agreement are not subject to any particular restrictions when structuring the provisions.

The basics of conversion

The conversion of a convertible loan is triggered by a “conversion event” – a financing round. This financing round determines a valuation (see also Startup Valuation Tool and Per- & Postmoney Valuation Tool), which in turn is used as the basis for converting the loan amount into company shares.

If no other special arrangements are made, the number of shares depends on the following 4 parameters: Share capital (or number of ordinary shares), amount of the convertible loan, amount of financing by the new investor and valuation at which this financing is provided.

The “conversion event”, i.e. the next financing round, determines the valuation of the startup. The share price at the time of financing can be easily calculated from the pre-money valuation (# stands for “number of”):

`text{Price per Share}= frac{text{Pre-Money Value}}{text{# Ordinary Shares}}`

Based on this share price, the investor receives the following number of new shares for his financing (# stands for “number of”):

`text{# Investor’s New Shares}= frac{text{Amount of Financing}}{text{Anteilspreis}}`

Without further special provisions, the previously calculated share price would be equal to the conversion price. However, most loan agreements provide for a discount that rewards the investor for its early commitment with a discount. The basis for the conversion price, the valuation, is reduced by this discount:

`text{Conversion Price}= frac{text{Pre-Money Value * (100% – Discount)}}{text{# Ordinary Shares}}`

The specific amount of the discount is, of course, a matter for negotiation, with 10-30% being standard market practice.

Case Study 1: Simple convertible loan with discount

A business angel (convertible loan provider) is prepared to invest EUR 400 thousand in a start-up that wants to launch a very innovative software solution on the market. There is great customer interest in this technology, which the startup can prove through several LOIs and sales talks.

However, in order to be able to supply the first customers with the innovative software solution, it must be completed to a certain extent – this is precisely what the start-up financing from the business angel is intended for.

Due to the high degree of innovation of the startup in question, the growth potential is also high, but difficult to quantify at this early stage. For this reason, the business angel and the founders agree on a convertible loan with the following conditions:

Startup Share capital = common shares 25.000 EUR = 25.000 Shares Terms of the convertible loan: Size of the convertible loand 400.000 EUR Discount 20% Terms of th financing round: Size of the financing 2.500.000 EUR Pre-Money Value 10.000.000 EUR

After a few months, the founders succeed in securing the next financing round with a financing volume of €2.5 million and a pre-money valuation of €10 million.

How many shares do the convertible loan provider and the investor receive and what does the cap table look like after this financing round?

In the first step, we calculate the share price for the financing:

` text{Share Price = } frac{10.000.000 text{ EUR}}{25.000 text{ Shares}} = 400 text{ EUR per Share} `

Based on the share price of €400, we can calculate the number of new shares for the investor:

` text{# New Shares Investor =} frac{2.500.000 text{ EUR}}{400 text{ EUR per Share}}= 6.250 text{ Shares} `

Now it is the convertible loan provider’s turn: Since a financing round has taken place (“Corversion Event”), he is entitled to convert his loan amount into shares at a discount of 20%:

`text{Coversion Price = }frac{10.000.000 text{ EUR}*(100%-20%)}{25.000 text{ Shares}} = 320 text{ EUR per Share} `

The convertible loan provider can therefore convert his convertible loan of EUR 400 thousand into 1,250 shares:

`text{# Shares from Conversion = }frac{400.000 text{ EUR}}{320 text{ EUR per Share}} = 1.250 text{ Shares} `

Conclusion: The granting of a convertible loan is not tied to a valuation; rather, this is only determined in the next financing round by the conditions of this later financing round. For its earlier financial commitment, the convertible loan provider receives a lower conversion price than the investor due to its discount. After the financing round and conversion, the following distribution of shares in the company results:

| Cap-Table after the financing | # Anteile | % Anteile |

| Founder | 25.000 | 76,92% |

| Investor | 6.250 | 19,23% |

| Convertible loan provider | 1.250 | 3,85% |

Additional terms in the convertible loan agreement

We have already outlined the most important parameters of a convertible loan, namely: loan sum , discount, size of the next financing round amount and valuation at the time of financing. In addition, the convertible loan provider and the founders are free to make further arrangements, such as:

Interest on the convertible loan

The convertible loan provider can charge interest on its financing – after all, it is a loan. In order to protect the startup’s liquidity, the interest should be structured as a bullet loan. It is also common for the interest claim to be converted into shares in the startup. This has the advantage that no liquidity flows out of the company, but the convertible loan provider can convert a higher amount and receive more shares in the startup.

If the convertible loan provider is also one of the shareholders, it is important to ensure that the interest rate is in line with the market. If the interest rate is too high, this can be penalized by the tax office, for example, as a hidden profit distribution. Consultation with a tax advisor is recommended here.

Thresholds for conversion: floor and cap

The cap is the upper limit of the valuation at which the investor may convert. This regulation is therefore advantageous for the convertible loan provider, because the higher the valuation, the fewer shares he would receive for his convertible loan.

Founders, on the other hand, should think carefully about a cap regulation, because if their company develops even better than expected and the valuation is significantly higher in the next financing round, the convertible loan provider can convert his shares at a very favorable price and thus receive more shares.

The floor, on the other hand, is a founder-friendly regulation, as it sets a lower limit for the conversion through the minimum valuation and thus prevents the convertible loan provider from receiving “too many” shares after applying any discount at a low valuation.

From the perspective of the existing shareholders, the floor can also serve as protection against a down round (i.e. the enterprise value in the current financing round is lower than in the previous financing round) and prevent the existing shareholders from asserting their dilution protection rights.

Case Study 2: Convertible loan with CAP and Floor

How do the share ratios in the previous example change if the investor has also agreed a CAP of €7 million and a floor of €5 million?

Case 2.1: €2.5 million financing at a valuation of €10 million

Startup Share capital = common shares 25.000 EUR = 25.000 Shares Terms of the convertible loan: Size of the convertible loan 400.000 EUR Discount 20% Cap 7.000.000 EUR Floor 5.000.000 EUR Terms of the financing round: Size of the financing 2.500.000 EUR Pre-Money value 10.000.000 EUR

In this case, the investor receives the same 6,250 new shares – nothing has changed, as the newly added cap is only relevant for the investor.

What is the situation for the convertible loan provider? The cap and dicount are relevant for the convertible loan provider. The valuation of €10 million is higher than the cap of €7 million, but the cap is lower than the valuation after the discount of €8 million = €10 million * (100%-20%). The convertible loan provider has the right to carry out the conversion taking the cap or the discount into account – but he may not use both, i.e. he may not discount the cap value further. Of course, he must choose the most economical solution for him:

` text{Conversion Price = } frac{min(7.000.000,8.000.000) text{ EUR}}{25.000text{ Shares}} = 280 text{ EUR per Share} `

The investor thus receives 1,429 shares from the conversion:

` text{# Shares from Conversion = } frac{400.000 text{ EUR}}{280text{ EUR per Share}} = 1.429 text{ Shares} `

For comparison: Without the cap, he would have received 1,250 shares – of course applying the discount. After the financing round and the conversion, the share distribution is as follows:

| Cap-Table after financing | # Anteile | % Anteile |

| Founder | 25.000 | 80,0% |

| Convertible loan provider | 1.250 | 4% |

| Investor | 5.000 | 16% |

Case 2.2: €2.5 million financing at a valuation of €4.5 million

How would the situation change if the same amount of financing was provided at a significantly lower valuation?

In this case, things would also change for our investor:

` text{Share Price = } frac{4.500.000 text{ EUR}}{25.000 text{ Shares}} = 180 text{ EUR per Share} `

Based on the share price of €180, we can calculate the number of new shares for the investor:

` text{# New Shares Investor =} frac{2.500.000 text{ EUR}}{180 text{ EUR per Share}}= 13.889 text{ Shares} `

In the case of our convertible loan, however, the founders have hedged against an undervaluation with a floor of €5 million, resulting in the following conversion price:

` text{Conversion Price = } frac{max(4.500.000,5.000.000) text{ EUR}}{25.000text{ Shares}} = 200 text{ EUR per Share} `

The convertible loan provider therefore receives 2,000 shares from the conversion:

` text{# Shares from Conversion = } frac{400.000 text{ EUR}}{200text{ EUR per Share}} = 2.000 text{ Shares} `

For comparison: Without the cap, he would have received 2,778 shares – naturally applying the discount. After the financing round and the conversion, the share distribution is as follows:

| Cap-Table after the financing | # Shares | % Shares |

| Founder | 25.000 | 80,0% |

| Convertible loan provider | 1.250 | 4% |

| Investor | 5.000 | 16% |

Conclusion: In the preceding examples, we have seen the significant influence of Cap and Floor on the conversion.

The Cap is advantageous for the convertible loan provider as it protects them from an overly high valuation. The disadvantage for the startup is that in the case of a very high valuation, the convertible loan provider receives their shares much cheaper than the investor.

On the other hand, the Floor protects the startup and ensures that in the event of a lean financing round with a very low valuation, the convertible loan provider does not receive too many shares.

Terms, conversion obligation and “mandatory conversion”

In practice, terms of between 12 and 36 months are common. However, there is no provision for repayment at the end of the contract term; the investor is only entitled to repayment in certain special situations. Instead, the investor typically has the right to a so-called “mandatory conversion” (also known as “forcible conversion”) at a valuation specified in the loan agreement. This valuation should of course be low enough to avoid creating false incentives for the founders.

Early Exit

If there is an exit before the next financing round (i.e. acquisition of more than 50% of the shares or more than 50% of the assets), the investor can no longer convert his loan amount into shares. Instead, he receives his loan amount plus an exit premium specified in the loan agreement. This is one of the few situations in which the investor receives cash instead of shares.

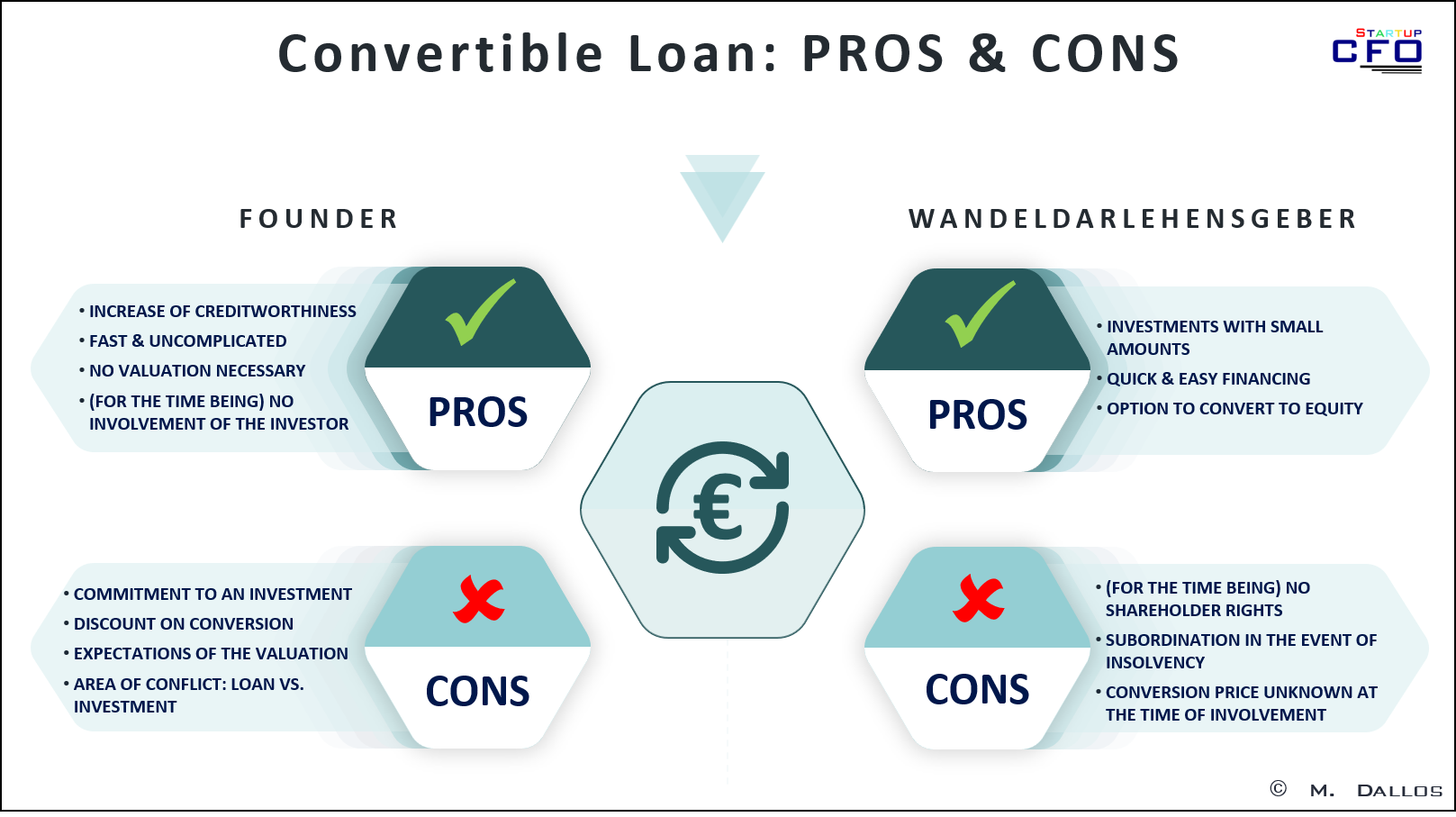

Advantages and disadvantages of convertible loans

Despite or precisely because of the wide range of possibilities for structuring convertible loans, both contracting parties, i.e. the startup with its founders and the convertible loan provider, must take various advantages and disadvantages into account.

Advantages from the founders’ perspective

Quick and easy financing without the need for a valuation

Due to the nature of the convertible loan, i.e. initially only a loan and only in the later financing round a conversion of the loan agreement into shares, the corresponding agreement can be concluded quickly. This bridge or start-up financing through a convertible loan is therefore very fast. If we were to talk directly about an investor’s participation, we would first have to agree on a valuation. However, there is often a lack of information about traction and turnover, as well as a lack of time for lengthy discussions.

As this contract does not have to be notarized by a notary and there are no other “special” requirements, the entire process is relatively straightforward.

No right of the investor to have a say (for the time being)

Until the time of conversion, the convertible loan provider does not receive any company shares and therefore no seat in the circle of shareholders. An initially unchanged group of shareholders can be advantageous for the founders, who can concentrate fully on building up the company, as not only the valuation but also the admission of new shareholders is postponed until the next financing round.

Subordination of financing through convertible loans

Convertible loans are usually subordinated. One advantage of the subordination of convertible loans is that they are treated as equity in the balance sheet and therefore increase the equity ratio. The equity ratio is an important indicator for debt financing; a higher equity ratio can make it easier to raise debt capital.

Disadvantages from the founders’ perspective

Commitment to investment

Even if the convertible loan provider may not immediately take a seat at the shareholders’ table, it is still a promise of future participation by the convertible loan provider.

Expectations of the valuation

When looking for further financing, the expectations of the convertible loan provider and the founders regarding the valuation of the startup may differ. If the founders assume that the valuation is too high, they run the risk of not receiving any financing. If the valuation is too low, the founders must issue a correspondingly large number of shares to both the investor and the convertible loan provider.

Area of conflict: loan vs. participation

Despite (or because of) contractual regulations, in reality there can be diverging expectations in the relationship between the convertible loan provider and the founder. For example, the convertible loan provider may see itself as a “de facto” shareholder and demand information and decision-making rights to which it is not entitled. On the other hand, after a very successful financing round with an unexpectedly high valuation, the shareholders may seek to repay the convertible loan instead of converting it into shares.

All this and much more from this area of tension can be avoided through clear and fair communication and corresponding contractual provisions.

Advantages from the convertible loan provider’s perspective

Investments with small capital amounts

Convertible loans are an ideal instrument for business angels to invest small sums in companies. Especially when it is most urgent, i.e. in seed or bridge financing, convertible loan providers can use the greatest possible leverage with their capital investment and secure the growth of the startup with a “small” sum and obtain a substantial investment. After all, if the startup is already qualified for VC financing, these small investors will have difficulties to obtain a seat at the negotiating table.

Fast, simple and with a conversion option

The conceptual simplicity of the convertible loan is not only appreciated by the founders, but of course also by the investor. In addition, the cinvestor receives a conversion right, very often at a discount to the investor in the next financing round.

The conceptual simplicity of the convertible loan is appreciated not only by the founders, but of course also by the investor. In addition, the investor receives a discount on the conversion compared to the investor from the next financing round.

Disadvantages from the convertible loan provider’s perspective

No shareholder rights (for the time being)

Before the conversion, i.e. before the next financing round, there is no entitlement to a seat at the shareholders’ table. This naturally also applies to reporting and information rights. The convertible loan must therefore contractually guarantee the desired information or other material rights. Common practice is the contractual assurance of the same information rights as shareholders in accordance with the GmbH Act (see §51a GmbHG).

Subordination of financing in the event of insolvency

The common practice of structuring the convertible loan as a subordinated loan strengthens the equity ratio of start-ups. For the convertible loan provider, this means that it is treated as a shareholder within the meaning of the Insolvency Code (see Section 39 InsO) – even before conversion. The convertible loan is therefore only repaid after all other creditor claims have been satisfied – provided there is still capital available.

Expectations of the valuation

Similar to the founders, the convertible loan provider’s expectations of the valuation in the upcoming financing round may differ from reality.

In practice, a situation may also arise in which no financing round materializes and thus the basis for the conversion price no longer applies. Provision should also be made for this case in the contract and a value for a “mandatory conversion” after the end of the contract term should be defined. This should be sufficiently lower than the value of the financing round in order to avoid creating false incentives for the founders.

Conclusion: Financing with a convertible loan

The convertible loan is an uncomplicated and quick financing solution for early stage or bridging financing. On the other hand, however, it is a promise by the founders to grant an equity stake in the future, i.e. to convert the loan into shares. The founders should be aware of this promise and the conditions to which they have committed themselves.

The Startup CFO is happy to support you with this complex topic – you can find our services ‘as a service’ here